I’ve seen many people who are so scared of keeping credit cards. One of their reasons was spending the money that you don’t have will financially damage you. On the other hand, some people are very proud of their credit cards. At one of the yahoo groups, I noticed some members boasting which credit cards would give you a better impression when you shop (they were not talking about Gold or Platinum, but from which bank such as Citibank, etc). And they tried to get those credit cards for the sake of impression.

I believe both are extreme ideas. In fact what can give you a better impression than spending your own money, like paying cash for your car or house? Besides, I doubt that a credit card from one bank can give you a better impression than that from another bank. Having said that, credit cards are not necessarily bad if you know how to handle them. There are good debt and bad debt, and if you carry only good debt, it can even give you a financial leverage.

I have a credit card and I want to share some of the tricks I use to earn money from my credit card. Yeah, you heard it right. The money I earn from banks by using this credit card is more than the annual fees I have to pay.

If you read my previous post about Savings Account, you will notice that I can earn nearly 5% per annum interest from my debit account. I keep all the money I would need in short term in that account as long as possible. I use my credit card for almost all expenses, such as rent, groceries, bills, miscellaneous expenses, etc. But I do keep track of my balance and I do make sure that I pay full amount of the closing balance every month so that I don’t have to pay any interest. So I never let any credit go past the “grace period” (the interest free period).

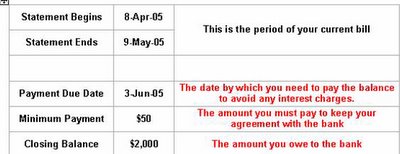

Here are the numbers in your credit card statement you need to give full attention to.

As you can see from the picture, if you don’t pay the bank the minimum amount ($50) by the due date (3 June 2005), the bank would send you a warning since you’re breaking the agreement to pay a certain amount back every month. But many people do take it wrong that they will be alright if they pay only the minimum amount. That will surely lead you into more debt since the bank is charging you a massive amount of interest for the rest of the balance; 9% to 19+% depending on the banks.

Since I don’t want to get charged any interest, I do make sure that I pay the “Closing Balance” back during the period (Statement Ends --> Payment Due Date). I just set a low limit for my card and the available credit in my card is nearly $50 any day of any month. I have compulsory expenses every week and every time I need to pay rent or shop, I deposit some money to my card and use it within days if not hours. It’s like I pay for the old balance and get a new balance that I can keep for another grace period (nearly 45 days). Since my monthly expense is around the “Closing Balance”, my credit balance keeps rotating every month although the available credit is nearly zero, and I don’t pay a cent for that.

I admit that I have to pay annual credit card fees about $60. So how do I earn the money back from banks? Instead of paying the debt straightaway like some cautious people & debt-haters do, I take advantage of the “grace period” and keep that money in my debit account. If I could keep only $1200 from credit card in my savings account for the whole year at 5% per annum in this way, the annual fees is paid off. But I do rotate more credit than that by paying rent & bills of some close friends too :-).

Another good thing about using my credit card is I can gain a point for every dollar I spend. When I have enough points, I can claim cash back bonus from the bank. Last week I redeemed 20000 points for $100 cashback. Woo Hoo!!! I still can claim $50 soon too.

So every year I can earn $100+ for using a credit card. You might say it’s not a lot. But, hey, while everyone is paying to use a credit card, I get paid for my credit card & for using someone else’s money in the smart way. It’s totally legal and ethical, and I have the convenience of using a credit card too.

To sum up,

1. Not every credit card is bad, if you know how to manage it.

2. If possible, pay the “closing balance” before the “grace period” and avoid high interest.

3. Rotate your balance & take advantage of “grace period” as I do.

4. Shop around for the best credit card with longest grace period, most bonus points, cheapest annual fees & lowest interest (if you can’t pay the balance).

5. Do not use your credit card for the sake of bonus points.

6. Do not use your credit card for the things you can’t afford to pay in cash within the grace period. (I use it for compulsory expenses that I would have paid in cash otherwise.)

7. Do not keep many credit cards, since "more credit cards = more annual fees".

8. Keep it secure!!!

Don't let banks rob you. Rob them instead!!!

Subscribe to:

Post Comments (Atom)

Great idea to educate others and I agree with you 100%. I have found two credit cards with no annual fee that I use exclusively. I have a CitiBank card with 5% back cashback on gas, groceries and pharmacy purchases and a BofA card with 1% cashback on all purchases. You can research the best deals on bankrate as well to find the best deal for you. Best Wishes!

Thanks a lot for the info, Dan. I absolutely recommend people to shop around and do their homework to get the best deal. A few weeks ago, I heard on TV that Citibank Australia was warning their credit card customers that if they don't spend $1000 in Dec, the bank will charge about $100 for bank fees. I'm not sure how accurate this info is. If it's true, that's really outrageous. Don't let any bank bully you like that. There are a lot of competitions around and you might find a special deal for balance transfer. Research, research, research!!!