We finally decided not to upload any more free Myanmar ebooks. We'll still leave the existing ebooks for download since we don't want to trash our efforts away, but there won't be any more new ebook from now on.

Converting ebooks was a good experience for us and we appreciate the interest we received from Myanmar booklovers. But.....

1. There is not a strong copyright law in Myanmar so we could keep copying if we want to. But regardless of copyright issue, we feel that it's not ethical to do so. Burmese writers have to struggle for their living, and even an author of 30+ successful books doesn't get rich in Myanmar. So if we keep copying their works like that, we would be financially damaging them. Why should we hurt our favourite authors and give them financial hardships? Instead, we should be supporting them so that they could create much greater works.

2. Most readers of our ebooks are outside Myanmar and we are very sure that every single one of them can easily afford to buy these Myanmar books, since each book costs less than a bottle of Coke. It is not fair for struggling Burmese writers if we're reading their books for free while we're paying a lot for books like Harry Potter, and the author is a multi-billionaire. It should have been the other way around if we didn't have to worry about copyright laws.

It was not an easy decision to make, but we are sure it is a wise and ethical decision. I hope our visitors would not mind about that, but acknowledge the fact that Burmese authors desperately need to make a living more than other authors do.

Thanks.

Two Reasons We Stopped Uploading Ebooks

Posted by Swanie | 11.12.05 | Ebooks, Myanmar | 4 comments »Than Lwin Ezine 5 And Blog

Posted by Swanie | 11.12.05 | Ebooks, Myanmar, Useful Links | 0 comments »To all Myanmar book lovers,

Than Lwin e-zine 5 (Dec 2005) is available at Thanlwinainmat.

There is a blog for Than Lwin (Link), where a special discussion under "Youth & Future Country" is going on.

Today I read the news about a 15 year old boy called Ram Bahadur Banjan, who has been meditating in a Nepalese jungle for "six months" without food or drinks, and thousands have flocked to see him daily, with some believing he is the reincarnation of Buddha. As a devoted buddhist, I feel this is outrageous and such an insult to Buddhism. How stupid these people are to believe that he is the reincarnation of Buddha?

Here are the reasons why I do not believe he is the reincarnation of Buddha.

1. Buddha has already attained Nibbana, the end of suffering and rebirth. What is the point of Nibbana and Enlightenment, if there is still suffering and rebirth after Nibbana?

2. Buddha will never reincarnate. Let's say he does, then why does he have to meditate again to be enlightened after he has been enlightened for more than two thousand years?

3. Why does this boy has to be kept from public at night? Does it suggest he may be eating or answering the call of nature at night?He's supposedly been that way since May 17 — but his followers have been keeping him from public view at night.

4. Buddha already realised that the middle path is the only path to Nibbana, and he abandoned "the suffering practice (without food)". Since then, he had eaten food in moderation. So why would the real reincarnation of Buddha adopt "the suffering practice" again? Why should one follow "the suffering practice" to attain Nibbana after even Buddha discarded it? Why should true believers of Buddhism worship people who is trying to attain Nibbana through "the suffering practice"?

So what about the fact that he can meditate without food or drinks? Since he can't be monitored around-the-clock, it is very hard to say that he lives without food or drinks for six months. As I said earlier, there could be a secret passage through which food and water is supplied to him at night and people will not notice at all. I suspect these so-called followers too. They could probably be trying to deceive people and they are already making a lot of money so far. If one day after the group has made enough money, the boy could escape through a secret passage, and all of these people may be left believing that he has been enlightened and vanished!!!

There is a slight chance that he is really meditating without food or drinks. But that is possible only if he has gained some kind of will-power or Ja-na (Zan) via meditation, and is enable to control his metabolism. That needs to be proved too.

To conclude, this is more likely to be a scam than a true story of meditating without food or drinks, let alone the reincarnation of Buddha. Even if anyone can meditate without food or drinks for six months, that person is not the reincarnation of Buddha or another Buddha (Sammasambuddha, who attains Buddhahood without any teaching from another person, and who can teach others to escape from Samsara). He could be an Arahat, but I absolutely doubt that too since he is not taking the right path.

Anyway, I can't wait to see how this boy will turn out soon.

What about your views?

Last week, I received a security device from HSBC Bank. It looks like a key chain and it has got a LCD display and a button. Whenever the button is pressed, it will generate a time-sensitive, single-use six-digit Security Code for you to use when logging on to Internet Banking. That code is needed together with user ID and password. It takes more process to log in now, but I think security has been greatly increased. The best thing is it's totally free.

Once-celebrated Chitika is under fire since they have disappointed most publishers with the new audit system. Some bloggers like Ingoal lost 96.28% from the audit. There are many complaints and discussions around too. According to the audit, you won't get paid for the clicks from "invalid countries" such as China and most Asian countries, and for repeated clicks from same IPs.

Fortunately, Chitika introduced "Alternate Ad" similar to Adsense. So visitors from invalid IPs will be presented with "Alternate Ad" you specified (Hopefully). This is the code you need to add to your existing Chitika code. (You can add this from Chitika if you're creating new codes.)

ch_alternate_ad_url = "XXXX";

You can add this line to the code (anywhere after the line with ch_client but before the line with /script). You need to replace the XXXX above with a valid URL like "http://yourdomain.com/alternateAd.html". The replacement Ad should be same size as the actual Chitika Ad, otherwise it will be cropped out.

But mind you, you cannot use Adsense as your alternate Ad, and this won't help you with clicks from repeated visitors :-(. I'll have to get one for my blog too.

I’ve seen many people who are so scared of keeping credit cards. One of their reasons was spending the money that you don’t have will financially damage you. On the other hand, some people are very proud of their credit cards. At one of the yahoo groups, I noticed some members boasting which credit cards would give you a better impression when you shop (they were not talking about Gold or Platinum, but from which bank such as Citibank, etc). And they tried to get those credit cards for the sake of impression.

I believe both are extreme ideas. In fact what can give you a better impression than spending your own money, like paying cash for your car or house? Besides, I doubt that a credit card from one bank can give you a better impression than that from another bank. Having said that, credit cards are not necessarily bad if you know how to handle them. There are good debt and bad debt, and if you carry only good debt, it can even give you a financial leverage.

I have a credit card and I want to share some of the tricks I use to earn money from my credit card. Yeah, you heard it right. The money I earn from banks by using this credit card is more than the annual fees I have to pay.

If you read my previous post about Savings Account, you will notice that I can earn nearly 5% per annum interest from my debit account. I keep all the money I would need in short term in that account as long as possible. I use my credit card for almost all expenses, such as rent, groceries, bills, miscellaneous expenses, etc. But I do keep track of my balance and I do make sure that I pay full amount of the closing balance every month so that I don’t have to pay any interest. So I never let any credit go past the “grace period” (the interest free period).

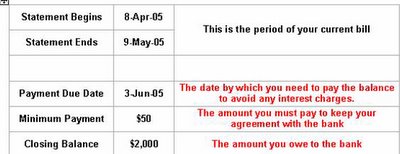

Here are the numbers in your credit card statement you need to give full attention to.

As you can see from the picture, if you don’t pay the bank the minimum amount ($50) by the due date (3 June 2005), the bank would send you a warning since you’re breaking the agreement to pay a certain amount back every month. But many people do take it wrong that they will be alright if they pay only the minimum amount. That will surely lead you into more debt since the bank is charging you a massive amount of interest for the rest of the balance; 9% to 19+% depending on the banks.

Since I don’t want to get charged any interest, I do make sure that I pay the “Closing Balance” back during the period (Statement Ends --> Payment Due Date). I just set a low limit for my card and the available credit in my card is nearly $50 any day of any month. I have compulsory expenses every week and every time I need to pay rent or shop, I deposit some money to my card and use it within days if not hours. It’s like I pay for the old balance and get a new balance that I can keep for another grace period (nearly 45 days). Since my monthly expense is around the “Closing Balance”, my credit balance keeps rotating every month although the available credit is nearly zero, and I don’t pay a cent for that.

I admit that I have to pay annual credit card fees about $60. So how do I earn the money back from banks? Instead of paying the debt straightaway like some cautious people & debt-haters do, I take advantage of the “grace period” and keep that money in my debit account. If I could keep only $1200 from credit card in my savings account for the whole year at 5% per annum in this way, the annual fees is paid off. But I do rotate more credit than that by paying rent & bills of some close friends too :-).

Another good thing about using my credit card is I can gain a point for every dollar I spend. When I have enough points, I can claim cash back bonus from the bank. Last week I redeemed 20000 points for $100 cashback. Woo Hoo!!! I still can claim $50 soon too.

So every year I can earn $100+ for using a credit card. You might say it’s not a lot. But, hey, while everyone is paying to use a credit card, I get paid for my credit card & for using someone else’s money in the smart way. It’s totally legal and ethical, and I have the convenience of using a credit card too.

To sum up,

1. Not every credit card is bad, if you know how to manage it.

2. If possible, pay the “closing balance” before the “grace period” and avoid high interest.

3. Rotate your balance & take advantage of “grace period” as I do.

4. Shop around for the best credit card with longest grace period, most bonus points, cheapest annual fees & lowest interest (if you can’t pay the balance).

5. Do not use your credit card for the sake of bonus points.

6. Do not use your credit card for the things you can’t afford to pay in cash within the grace period. (I use it for compulsory expenses that I would have paid in cash otherwise.)

7. Do not keep many credit cards, since "more credit cards = more annual fees".

8. Keep it secure!!!

Don't let banks rob you. Rob them instead!!!

What a funny story!!! Luckily the airline gave him a free ticket.It's not uncommon for airline passengers to doze off during their flight. But for 21-year-old Tor Martin Johansen, the snooze lasted through an entire round trip.

source

Johansen fell asleep on a short flight from central Norway city of Trondheim via Roervik to his hometown of Namsos on Thursday. When he woke up, he was back in Trondheim.